Reconcile Payments Faster with Remittance Advice Extraction

Remittance advice are important documents that many businesses rely on to help reconcile payments. Used to confirm customer payments and match them with invoices and credit notes, payment remittance advice documents assist the finance team with their day-to-day operations and keeps the business running efficiently. It is also instrumental in managing productive relationships with other businesses.

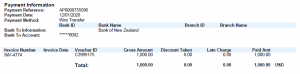

A remittance advice document typically includes a list of invoices that the client is including in a payment to their supplier. It will usually provide a table of the invoices being paid and the total amount of the remittance advice should exactly match the funds received or check value. These documents are invaluable in helping suppliers, especially those who issue the same client with many invoices to determine which of their debtor invoices are being paid with the money they are receiving from that customer/debtor. Remittance advice documents may also include credits the customers are applying to invoices which can also help the supplier track how their customers are applying issued credits.

Figure 1 – an example of a remittance advice document

Payment reconciliation without remittance advice is challenging for several reasons. Mismatched payments and invoices force vendors to engage in unnecessary follow-ups with customers, increasing communication overhead. Disputes over pricing and services become harder to resolve, and miscommunication, such as resending paid invoices, is just one of many costly errors that can harm business relationships.

These challenges are all compounded by the number of invoices and payments that need to be reconciled. Matching invoices to payments using remittance advice is difficult when dealing with a large volume of invoices across multiple accounts. Whether sent electronically or attached to paper checks and invoices, sorting through business transactions is time-consuming and prevents in-house finance from focusing on tasks that improve and optimise the business instead. A business may have to handle hundreds of scheduled or one-off payments with limited resources, whether time or people.

Digital document extraction software, such as Xtracta, does this work for you and removes these barriers to reconciling payments; it reads and interprets the contents of the uploaded documents. First, it can help find remittance advice documents from incoming document streams through document classification processes, it then can produce structured remittance advice data from a variety of incoming document formats. This same process also notifies you if remittance advice data is missing. Read on to discover how automated remittance advice extraction can streamline your reconciliation process and boost business efficiency.

How does remittance advice extraction work?

The type of key information usually contained in remittance advice documents that are extracted include:

- Payment dates

- Payment amounts

- Invoice/credit numbers

- Customer’s name, address and contact information

The way these are formatted can vary, and for a large organisation, reconciling payments manually using remittance advice can represent a significant amount of work for finance teams. Document data extraction technology can take a remittance advice document and convert the data into a structured digital format. This can then be used to automatically apply the payment against the invoices and credits owed by or to the customer.

Driven by OCR AI and machine learning technology, extraction software can learn from each document it analyses. As it familiarises itself with your business and the documents it receives, the extraction process becomes more efficient over time. With the capacity to learn without supervision or manual fine-tuning, the potential savings on time and energy are significant.

This is also helpful when a business enters a relationship with a new customer or when an existing customer changes how they format their remittance advice. Every organisation will likely have their documents set up in their own way. Whether the differences are cosmetic or more substantial, AI powered document data extraction software can find and interpret remittance advice without needing additional rules or templates to be set up by specialist engineers.

Because extraction technology understands the parameters of what it is looking for, new documents generate very little extra work for the user.

Once the remittance advice has been identified and extracted, it is presented in an actionable way for a business to ensure that payments have been reconciled properly. Verifying payments, matching these to invoices, and overall payment reconciliation becomes more manageable when manually processing remittance advice is no longer necessary.

Integrating extraction technology with software such as automatic billing systems further enhances the ability to reconcile payments faster. As a result, the volume of invoices a business handles also becomes less time-consuming. Payments can be programmatically assigned to specific invoices, improving the overall efficiency of accounting teams.

Benefits of paperless remittance advice management

Data extraction technology facilitates transitioning to a paperless invoice management system, giving your business a competitive advantage. Paper checks often slow down payment reconciliation. When there are hundreds or thousands of transactions to sort through manually, organising these is time-consuming, and payment errors could be missed. Remittance advice extraction software allows you to save time and energy while identifying potential accounting issues quickly before they escalate.

Digitalisation then helps consolidate the different transactions and accounts you are dealing with. Once the remittance advice is captured, connecting it to ERPs or accounting systems maximises the time-saving opportunities. Payment reconciliation becomes more streamlined, and minimal switching between systems is required because of Xtracta’s compatibility with existing internal systems.

Xtracta is also capable of interpreting invoices and other document types, enabling a centralised approach to data management. Besides major improvements to productivity, in the long term, your business retains a historical record of remittance advice, invoices, and other documents, which won’t be impacted by staff turnover. This represents a significant return on investment when utilised to its full potential.

To learn more about remittance advice extraction and how it can help your business achieve its goals more effectively, contact an Xtracta expert today.